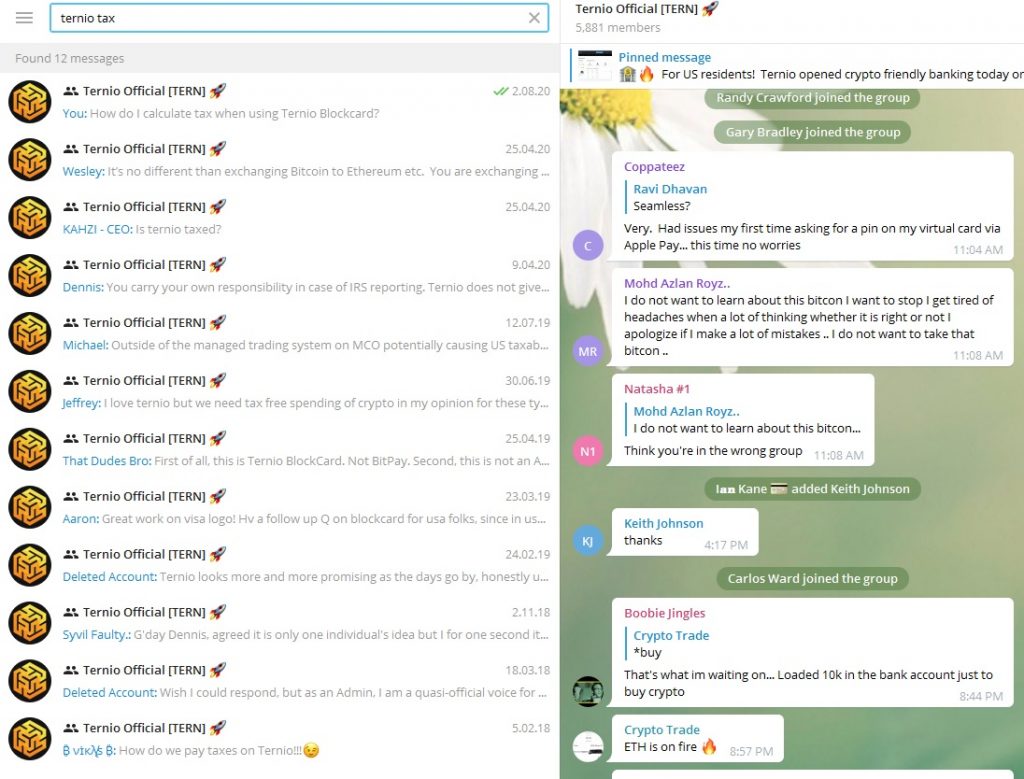

This person asked: ” [02.08.20 23:10] How do I calculate tax when using Ternio Blockcard?” Got No answer as of now.

KAHZI – CEO, [25.04.20 20:22]

How would a tax professional give me advice on your currency?Wesley, [25.04.20 20:27]

[In reply to KAHZI – CEO]

It’s no different than exchanging Bitcoin to Ethereum etc. You are exchanging Bitcoin to Tern. You would be responsible for keeping up with your own taxes. No exchanges advise on taxes. Why would Ternio be any different?

Is ternio taxed?

Are you asking if transactions are taxed when we buy things with the card because we are selling Tern when we make purchases?

Does this card keep logs of online purchases and withdraws and does it get reported?

You carry your own responsibility in case of IRS reporting. Ternio does not give or provide any tax advice. You are free to share the data on your dashboard with your CPA

Michael Kocher, [12.07.19 00:17]

[In reply to J.C]

Lol… good choiceI think tax liability is another interesting discussion point… comparing the function of the cards – and how trade gain liabilities are addresses on MCO.. at least for US citizens that could be messy..

Michael Kocher, [12.07.19 00:27]

Outside of the managed trading system on MCO potentially causing US taxable grief – I like that there is only tax liability on gains for only the purchase amount on TERNIO – with 100% holding head room.. vs a loading a specific amount on fiat debit card – that’s a tax liability for the entire loaded amount at time of cash out, and your limited to the amount of the cash out for headroom…It’s all interesting points of conversation…

You have a great night – I have 6hrs of driving ahead of me – right away in the morning – so I need to put a pin this product debate, and try to sleep.. take care JC…

Jeffrey Carter, [30.06.19 11:32]

I love ternio but we need tax free spending of crypto in my opinion for these type of platforms to really take offDeleted Account, [30.06.19 12:57]

Tax free ? I mean literally 4 dollars to load the card then sales tax? I mean as long as you stay in crypto why would you ever need to pay capital gains tax you leave the value in crypto. Can someone maybe clarify if my assumption are correct?Archer Bullseye, [30.06.19 13:02]

[In reply to Deleted Account]

He is likely talking about the federal tax implications behind spending cryptoDeleted Account, [30.06.19 13:02]

At a store ?Archer Bullseye, [30.06.19 13:04]

Spending crypto is a tax event and may generate capital gains or losses, which can be short-term or long-term. For example, say you bought one coin for $100. If that coin was then worth $200 and you bought a $200 gift card, there is a $100 taxable gain. Depending on the holding period, it could be a short- or long-term capital gain subject to different rates.

First of all, this is Ternio BlockCard. Not BitPay.

Second, this is not an ATM card. It is a (crypto) prepaid debit card.

Third, i believe cash back is a functionality of the cash register that is at the retailer’s discretion. If you buy a $20 item and want $10 cash back, a transaction of $30 is posted to the card and the cashier hands you 10 bucks out of the till. Cash back is typically “rung up” as a tax differed “item”.

Great work on visa logo! Hv a follow up Q on blockcard for usa folks, since in usa every crypto txn is taxable event, so will ternio help with tax form, generating txns buy/sell data that is schedule D form?

I𝐚𝐧 Kane 💳, [23.03.19 10:19]

[In reply to Aaron]

Yes, we provide a transaction history so regardless of where you are in the world, you have whatever necessary informatio is required to follow your local lawsI𝐚𝐧 Kane 💳, [23.03.19 10:19]

login to your account and you should see a “transactions” tab at the tp

G’day Dennis, agreed it is only one individual’s idea but I for one second it 100%, would you be so kind as to forward it to the team, as I think it would be an extremely big draw card, I didn’t know that you could achieve the same tax incentive via Visa but if you cut out the middleman (Visa), it makes Ternio more streamlined to the masses, hence a one stop shop.

Wish I could respond, but as an Admin, I am a quasi-official voice for Ternio. I cannot give you tax advice. I can share that since the value in any event of a single win is less than US$600, there will not be any tax documents sent to you. if you win more than once, then tax documents will be sent. Ternio would through that doc be making a valuation statement which would establish your basis in the event of future gain or loss. Sorry, can’t go any further